california property tax payment plan

For example if you defaulted on. This plan provides a means of paying secured.

For prior year secured property tax delinquencies a property owner may initiate an installment plan of redemption to redeem the property.

.png?width=1024)

. File a written request with the Tax Collectors office prior to the due date of the bill. Two types of Payment Plans either monthly or annual - are now available to taxpayers with real property that has unpaid prior year property taxes going back up to five 5 years. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code.

If you have any questions regarding this Payment Plan please call the Tax Collectors Office between 900 am. The Online Property Tax Service is provided to allow easy access for the public to Pay Print and View El Dorado County Property Tax Bills. Post Office Box 512102.

Each online creditdebit card transaction is limited to 9999999 including a service fee of 222 percent of the transaction. The BOE acts in an oversight capacity to ensure compliance by county assessors with property tax laws regulations and assessment issues. California Mortgage Relief Program for Property Tax Payment Assistance.

The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. If you have any questions regarding this Payment Plan please call the Tax Collectors Office Secured Property Tax Unit between 900 am. Monday through Friday excluding.

To perform the oversight. Payments made to the Department of Tax and Collections are typically processed within 2-5 days of receipt. The payments are payable over a four-year period as per California Revenue and Taxation Code.

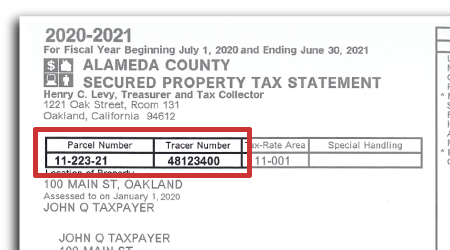

On the last business day of the fifth fiscal year after the property originally became tax-defaulted. For a copy of the original Secured Property Tax Bill please email us at infottclacountygov be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at. Monday through Friday excluding holidays at 925-608-9500.

You may mail your completed application and payment to the address below. You may also pay online by using major credit cards or debit cards. You may be required to pay electronically.

Website Accessibility Certification Agency California. A convenience fee of 25 will be charged for a credit card transaction. County of Los Angeles Treasurer and Tax Collector.

This office is also responsible for the sale of property subject to. Please be aware of the following regarding EFT. You can pay online by credit card or by electronic check from your checking or savings account.

No fee for an electronic. Authority for the installment plan is prescribed by Revenue and Taxation Code sections 4216-4337 and Placer County Ordinance Number 4759-B September 17 1996. Learn more about SCC DTAC Property Tax Payment App.

The deadline to set up a five-year payment plan is 5 pm. DECLARACIÓN DE KEITH KNOX TESORERO Y.

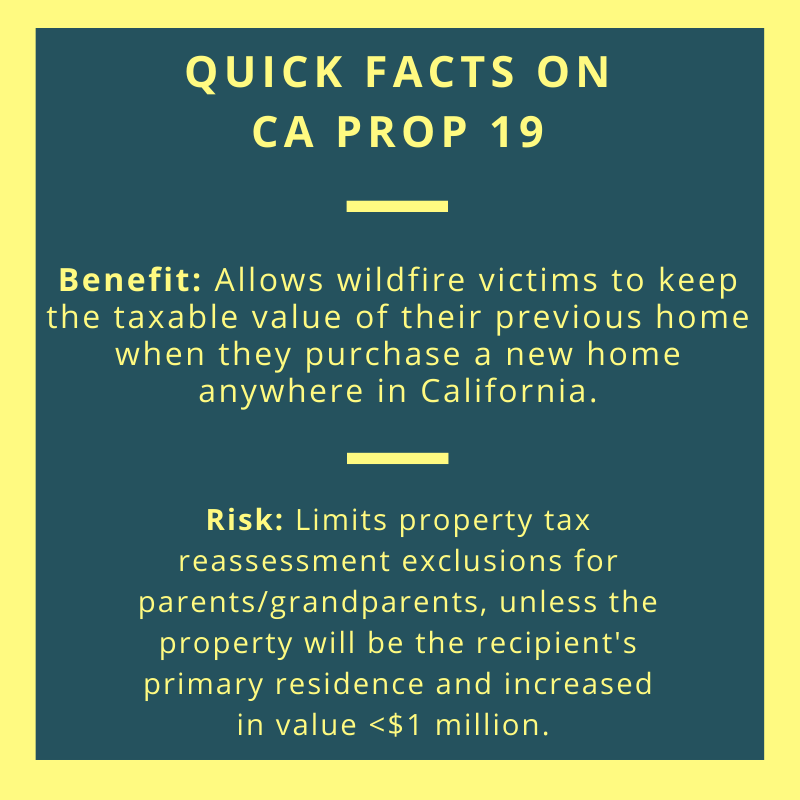

How Prop 19 Could Affect Your Estate Plan Law Offices Of Daniel A Hunt

Aci Payments Inc Pay California Property Taxes Online

Complete Guide To Property Taxes In San Diego

Property Tax Calculator Estimator For Real Estate And Homes

State Accepts Payment Plan In San Jose Ca 20 20 Tax Resolution

Monterey County Property Tax Guide Assessor Collector Records Search More

Treasurer Tax Collector El Dorado County

California Property Tax Calendar Escrow Of The West

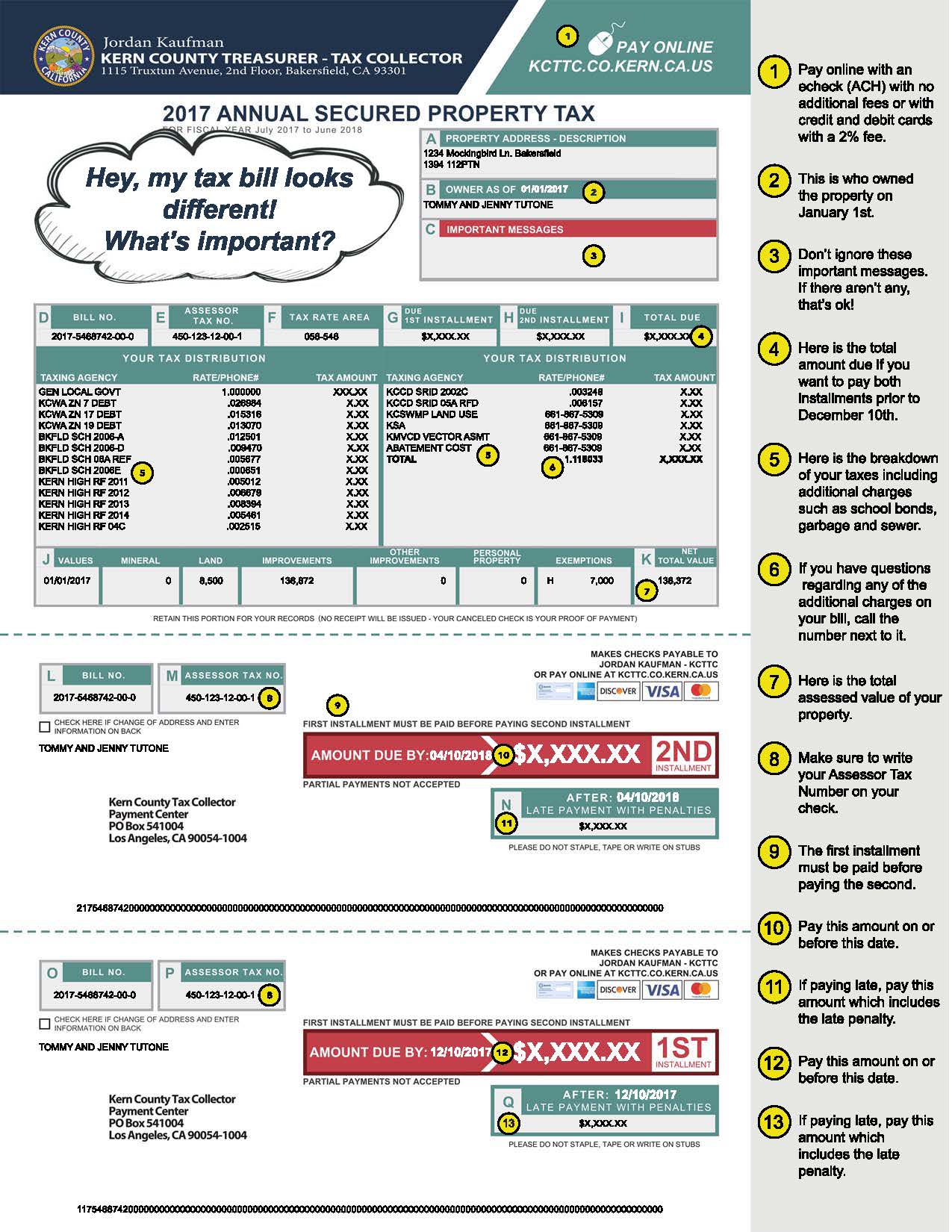

Kern County Treasurer And Tax Collector

California Mortgage Relief Program On Twitter Getcaughtup On Past Due Housing And Property Tax Payments Homeowners May Be Eligible If They Have Faced A Pandemic Related Hardship Due To Covid 19 They

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

California Enacts Property Tax Relief Measures Sacramento Business Journal

Annual Secured Property Tax Bill Placer County Ca

How To Transfer California Property Tax Base From Old Home To New

Disabled Veteran Property Tax Exemptions By State And Disability Rating

How To Find Tax Delinquent Properties In Your Area Rethority

Property Taxes Department Of Tax And Collections County Of Santa Clara